Online payroll software can be an excellent addition to any business. It is because it helps to manage, organize and automate the employee payment. Moreover, it helps track all the criteria required to make payments and maintain essential data related to payment.

One can say the payroll software for accountants helps the company leaders to perform better and understand how the company is working. Moreover, it gives better insight for the financial health of the company. Now you may be thinking about which software can be better? What you should use to get positive outcomes.

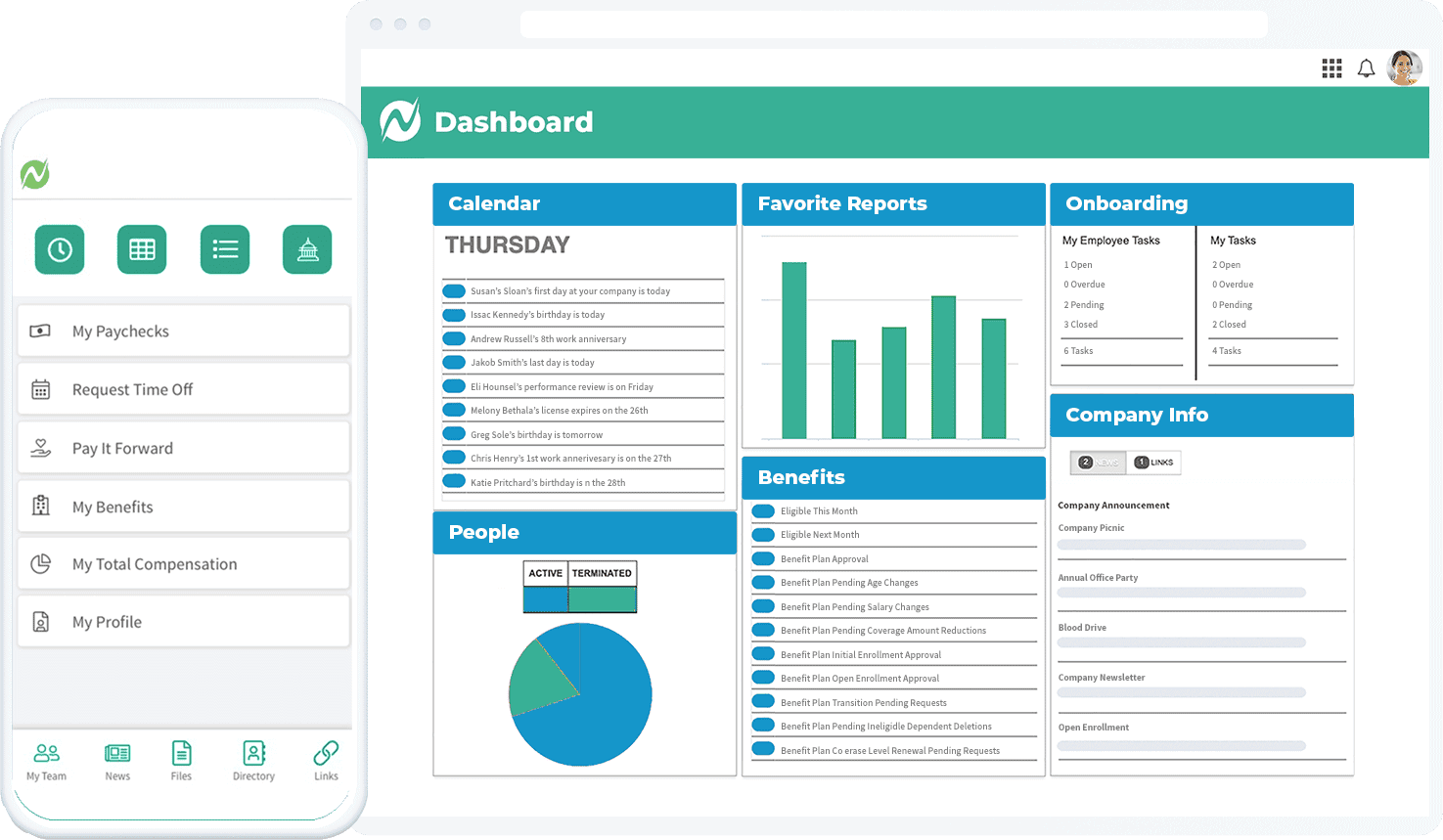

We have a solution for you. Give a chance to Netchex, one of the top-rated payroll software that comes with all features that you expect from the best payroll software.

Table of Contents

What features make Netchex ideal?

Now the question may come to your mind: why you should use Netchex and what features make it suitable for small and large-scale businesses. Let’s have a glance at the features that payroll software offers to users.

Exceptional working

The key feature that makes Netchex stand out among the crowd is its exceptional working feature. It tracks and calculates the correct number of hourly employees, attendance, and time as the amount you have to pay to employees. Plus, for salaried employees, the software tracks the software’s payment, benefits, and paid time off. Thus, it sums up the whole pay that is accurate.

Tax calculation

One of the most significant advantages of using Netchex is that it helps in the automation of processes of tax. Businesses have to withhold a certain amount of each paycheck for tax purposes. To maintain the balance of pays and checks. The withholdings include medicare, federal, state unemployment, social security, and income tax.

Payroll software manages the tax system efficiently, and the company does not find any inaccuracy in withholdings. Thus, a company can do tax audits with accuracy.

Few to no cost errors

One of the best things about payroll software is that it does not allow any pay errors. As we see in manual processes in which different mistakes occur. These include tracking employee hours, accounting for deductions, taking a lot of time, and errors during issuing payments. In contrast, when you use the software, you don’t get such errors.

Offer desired features

The payroll software offers the business all desired features. Either you want wage garnishments, in-depth reporting, payment options, or workers comp everything you can do with Netchex.

Help in HR integration

Another incredible feature of Netchex is that it helps in HR integration. The solutions you get from are the API data feed, single-source integration, and much more. One can check for this powerful solution, so HR works seamlessly to fill the needs of HR.

Functionality

Netchex is one of the best payroll software because it provides access, information, and cost functionality to every company’s department. The different functions of Netchex software are

- Time and attendance integration

- Integration of administration

- Cross company reporting for the labor cost analysis

- Employee self-service real-time accruals and PTO requests.

Paycheck system

Payroll software is best as it features a paycheck system. As the workforce nowadays is remote part-time, salaried, and seasonal. Netchex offers the payment system according to needs and employees.

Perfect accounting system

One best thing is that Netchex eliminates the whoops, Uhohs, and oops from your pay system. It offers complete analysis and pre-processing reports that are completely free of error. It includes instant preview processing. These are given as below.

- Detailed exception reporting

- For funding the use of liability reporting

- Before processing the use of the Gross to net views of data.

Final Verdict

If you want to make the payroll system free of errors and release payments, and keep a tax check properly, use Netchex. This will help to make your payroll system well organized. You can give salary to employees on time, make tax audits, maintain the accounts as well as make HR well integrated. Thus the software can be a breeze for the pay department as it holds 90% work of the pay management.

Alex is fascinated with “understanding” people. It’s actually what drives everything he does. He believes in a thoughtful exploration of how you shape your thoughts, experience of the world.