The single-touch payroll or STP is a method of reporting tax and superannuation information to the Australian government. Because the government regulates this process, it is mandatory, and there are penalties for businesses or companies that are non-compliant. Whether STP will affect your business today or next year, you need to prepare for this shift in tax reporting.

Unfortunately, not all businessmen are aware of the significance of STP, which could lead to hefty fines and administrative penalties.

If you are a responsible entrepreneur, you should comply with the Australian government’s requirements regarding tax and superannuation reporting.

This article will talk about single-touch payroll and the essential things to know about it as a business owner or founder.

Table of Contents

How Does Single-Touch Payroll Work?

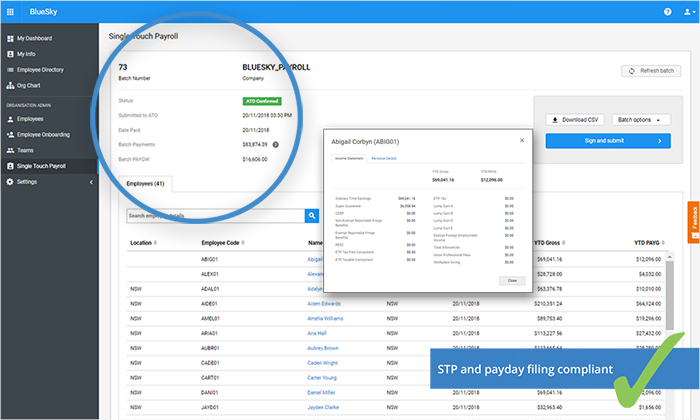

Single-touch payroll works by reporting tax and superannuation to the Australian Taxation Office through accounting software or STP-enabled payroll.

Other business information, such as salaries, pay-as-you-go (PAYG) withholding taxes, and wages are also sent to the government electronically using payroll software.

Australian businesses and companies have been mandated by the country’s government to report business information through single-touch payroll since July 1, 2019.

This is to streamline the payroll reporting process so that the government can ensure that business owners pay their employee tax obligations promptly.

What are the Benefits of STP to a Business?

One benefit of STP is that employees can check their year-to-date pay details. This helps them to be assured that their employer is responsible for meeting their tax and superannuation obligations.

Also, STP employees no longer need end-of-financial-year payment summaries, which means less paperwork and processes for your business.

Another advantage to the business is that the annual payment summary statement will no longer be needed.

Salaries, wages, and PAYG withholding taxes will also be prefilled in the business activity statements because of single-touch payroll, which means less administrative work for your business.

What is the Significance of having STP Software?

Before STP, small businesses could use spreadsheets or even pen and paper to submit their reports to the Australian Taxation Office.

On the other hand, bigger businesses were able to use desktop payroll software to submit their reports. But because of the new STP guidelines, previous methods of reporting have become difficult.

Today, written reports need to be converted into digital data and made into compliant digital reports, and you still need to find a service that can submit STP on your behalf.

Manually made digital reports must be converted to the Australian Tax Office’s required format before being submitted. Fortunately, STP software provides a solution to all this hassle.

STP software can handle every process of STP reporting. It can convert your data into a compliant digital report that is in the appropriate format of the Australian Tax Office.

With STP software, you rest assured that you will no longer have STP reporting problems and be fully compliant with the government’s regulations.

In the world of business, efficiency is quite significant because it enables businesses to become more effective. Single-touch payroll software is a technology that every business needs to streamline reporting tasks.

Erica Jones is a freelance writer and a GOT fan. Apart from writing Technologies, she likes to read & write fiction. More than anything, she loves to spend her time with her family, explaining technologies to the elders.

1 comment

Great post thanks for sharing such enlightening post with us all. As we all know that payroll is an important aspect of any business and most of use get scare when we hear about taxation but your post calmly helps in making STP clear to all your readers and helps in nullifying all doubts from the minds of all the readers.

Nice work keep it uop.