Managing your money can be quite a challenge. At some point in our lives, we all may come across a moment where we’re handling an overwhelming amount of debt, maintaining a substantial credit score or living off of an unorganized, or even nonexistent budget. It’s important to remember that any financial downfall can lead you to do a complete 180° when it comes to your money, so it may only take a sudden mishap to motivate you into turning your financial status around for the better.

With National Financial Awareness Day right around the corner, it’s the perfect time to take control over your finances! Here are some steps you can take to improve your financial wellness in no time:

Table of Contents

Develop a List of Goals

Setting goals, whether they’re long-term or short-term, can help you keep certain aspects of your life on track. When it comes to your finances, it’s imperative to develop a plan in order to make smarter, more consistent money-related choices.

Once you have your goals documented, make it a priority to stick to them. Staying on top of the habits associated with your savings will make financial related decisions moving forward a whole lot easier.

Be Smart With Your Budget

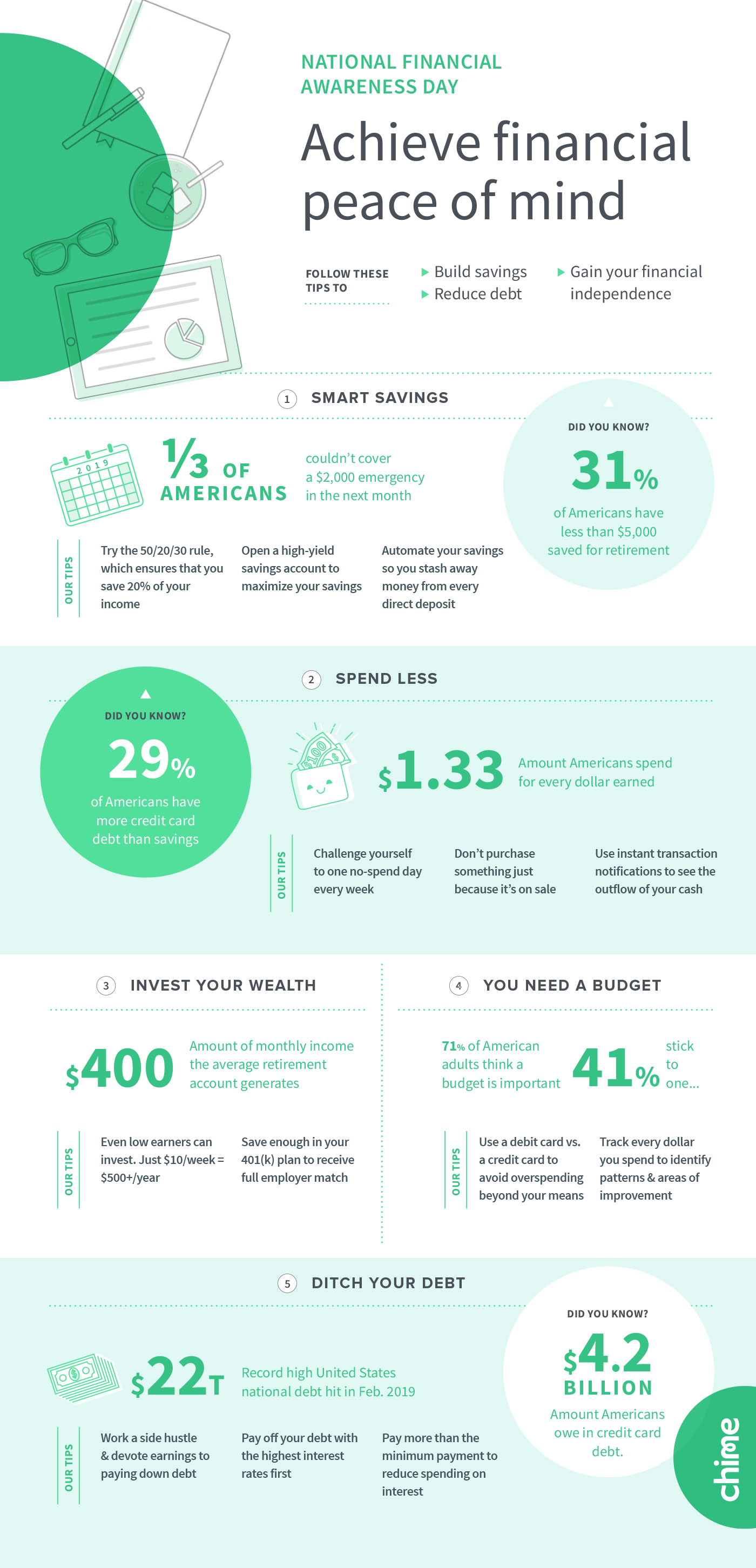

Creating a budget is always a smart choice if your main aspiration is to get your financial life back on track. In order to establish this plan for your money, gather as much information as you can pertaining to your salary, your monthly expenses, and any other regular purchase you might make like groceries or personal goods. When you’ve identified the amount of money you spend month-to-month, you’ll have a better idea of how much of your paycheck to save without falling into a financial pitfall.

Control Your Spending

Overspending is a behavior that can be improved by identifying the triggers that will keep you from reaching your financial goals. Items such as coffee, food, and clothing might be hard for you to pass up due to a constant craving for coffee shop caffeine, or a desire to stay updated with the latest trend.

Although it’s okay to splurge once in a while, too much spending in this category can throw off the balance of your budget, making the allocation of money needed to pay off your required bills even more difficult and nerve-racking.

Always make it a goal to focus on the necessities first, rather than trying to keep up with your peers who may be living above their means. It might be a difficult task now, but it will be worth it when you realize the savings you have built through setting a personal spending limit.

Build Your Savings

Saving money is an incredible habit that can improve your financial status right away. With each paycheck, it’s vital to associate a certain percentage of what you make towards a savings account in order to build a retirement fund or save for bigger purchases later on in life.

A savings account can be set up through both an in-person or online bank account or app, with the option to set up your savings automatically. With consistent deposits on a regular basis, your finances will benefit enormously in the long-run.

Communicating with your company about the 401K options available to you can be beneficial in order to receive a full employee match. That way, a chosen amount of your paycheck will be deposited into a retirement savings account, giving you the ability to save until you retire!

Establish a Plan For Your Debt

According to a recent statistic, 22 trillion people are in debt this year, and out of that massive group of individuals, 4 million are dealing with credit card debt specifically. This number is at a national high, showcasing that debt is not an easy thing to deal with. The great news is that there are a variety of ways to handle paying it off with ease.

Consider a side hustle or a part-time job to make more money. With more cash flowing into your account, the more efficiently you’ll be able to pay off your debt. When you’re choosing the repayment plan that is best for you, consider paying off more than the minimum payment to start to decrease the time you’re paying back your debt exponentially.

Alex is fascinated with “understanding” people. It’s actually what drives everything he does. He believes in a thoughtful exploration of how you shape your thoughts, experience of the world.